The Sustainability Recession: What It Is and Why It Matters 🌍

Recently, I shared an article about the sustainability recession, and the response was unexpected. While many found it insightful, some reacted aggressively—even unsubscribing. This reaction is concerning because it highlights the polarization around sustainability. But we need to avoid radical extremes and instead focus on facts and reflection to find ways to improve.

So, what exactly is the sustainability recession, and why should we care?

Understanding the Sustainability Recession

Just like a traditional economic recession, the sustainability recession represents a period of decline in sustainable trade and investment. We’re seeing it manifest in the slowdown of green bond issuance and the outflow of funds from sustainable investments—reflecting a drop in confidence in green finance.

But there’s more to it. The sustainability recession also reflects a shift in corporate sustainability, where initiatives are increasingly driven by regulatory compliance rather than genuine ESG integration. Companies are focusing more on disclosure over innovation. What once offered a competitive edge has become a box-ticking exercise. This superficial approach is reducing effectiveness, as many businesses lose sight of their long-term sustainability goals.

📉 ESMA Report Findings: Is the Green Economy in Decline?

The 2024 ESMA TRV Report highlights several concerning trends that echo the sustainability recession:

Green Bond Market Slowing: After years of steady growth, green bond issuance slowed in late 2023, raising concerns about mobilizing private capital to support the low-carbon transition.

Outflows from Sustainable Funds: For the first time in years, sustainable funds saw net outflows in late 2023, as investors questioned the financial returns and impact of ESG investments.

Greenwashing and Investor Distrust: Companies exaggerating their sustainability efforts are eroding investor trust, potentially stalling future capital flows into green initiatives.

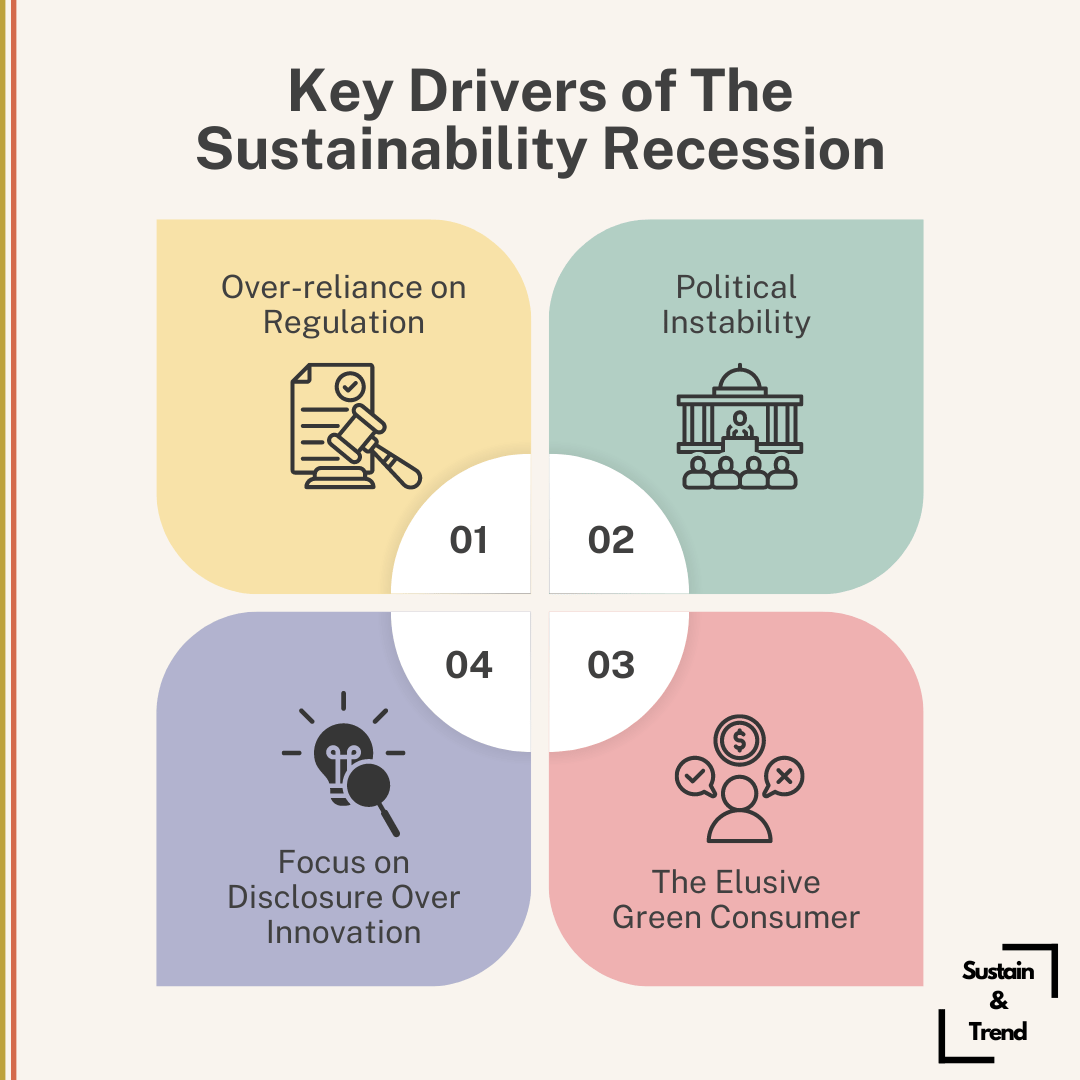

Key Drivers of the Sustainability Recession

Over-reliance on Regulation: When driven solely by compliance, sustainability becomes a bare-minimum exercise that lacks real-world impact.

Political Instability: Changing political priorities, especially in markets like the U.S., create uncertainty, making long-term sustainability commitments difficult.

Focus on Disclosure Over Innovation: As companies prioritize regulatory disclosure over true innovation, it becomes increasingly difficult to make a strong business case with a solid ROI for sustainability. This shift has discouraged investment in more impactful, innovative sustainability strategies.

The Elusive Green Consumer: While many consumers voice their preference for sustainable products, their actual buying behavior often reflects economic concerns over environmental ideals.

Why It Matters

If companies continue to treat sustainability as just a compliance exercise, the progress we’ve made over the past decade could be undone. As the ESMA report points out, private capital for the green transition is at risk if businesses don’t embrace authentic, innovative ESG practices.

The Path Forward: Moving Beyond Regulation

To counter the sustainability recession, businesses must move beyond compliance and towards genuine, innovative approaches. Here’s how they can do it:

✅ Reassess Strategies: Focus on long-term goals and impact rather than just meeting regulatory requirements.

✅ Increase Transparency: Rebuild trust by providing clear, verifiable data and credible transition plans.

✅ Lead by Example: Commit to innovation and authentic sustainability practices, setting the standard for others to follow.

The sustainability recession doesn’t have to be inevitable. Sustainability is an opportunity, not a burden, to create value—social, environmental, and financial. Let’s approach it with facts, not fear, and ensure a truly sustainable future.

If you are enjoying this content don’t forget to follow me on LinkedIn for more updates and insights.

Also subscribe to my YouTube channel for upcoming content—stay tuned for exciting videos! Once we hit 500 subscribers, I'll start transforming all the content into engaging video format. Stay tuned!

1 Must-See Post: Leading the LinkedIn Feed

A post about the illustration by Akepa of a periodic table not the regular one but one focused on sustainability certifications. Check it out here.

2 Great Insights - A Book I am Reading

⚠️⚠️⚠️

Shall we remove the books insights section?

3 Key Takeaway - Podcasts on the Move

⚠️⚠️⚠️

Shall we remove the podcast insights section?

There’s no book or podcast recommendation this week. This section is about sharing my personal interests beyond sustainability. If you find it valuable or think it’s better left out, please take 4 minutes to share your thoughts in this quick survey. Your feedback is important!

If you are enjoying this content don’t forget to follow me on LinkedIn for more updates and insights.

Also subscribe to my YouTube channel for upcoming content—stay tuned for exciting videos! Once we hit 500 subscribers, I'll start transforming all the content into engaging video format. Stay tuned!