In today's interconnected world, the spotlight on corporate responsibility has never been brighter. With regulators, investors, and consumers demanding higher standards, the journey towards a sustainable supply chain is no longer just a choice—it's a necessity.

Companies are now required to meet stringent environmental regulations and uphold social and human rights, navigating a complex landscape of expectations. This brings us to a crucial question: can companies turn supply chain compliance into competitive edge and secure investments?

Here are our 4 major pillars of a sustainable supply chain—regulatory compliance, investment attraction, competitiveness, and risk management—highlight why robust supplier engagement and due diligence are essential. As businesses strive to meet these demands, they must develop strong programs that ensure their supply chains are sustainable from start to finish.

In this article, we will cover:

Regulatory Landscape: A detailed look at supply chain regulations, especially in the EU.

Investment Attraction: Exploring how sustainable supply chain actions are interpreted by rating agencies.

Competitiveness: Examining how sustainability affects a company’s competitive edge.

Risk Management: Discussing the importance of mitigating risks and enhancing supply chain resilience.

Understanding these major pillars will help build a resilient action plan, ensuring your supply chain is not only sustainable but also strategically advantageous.

This is the biggest argument for buying into sustainable supply chain action. We will delve into details on how it is becoming mandatory to report and engage your value chain stakeholders, at least in Europe. But what if you are located elsewhere? This means you might be affected while doing business with European companies, and it is possible that regulations might shift where you are conducting business currently.

The regulatory landscape surrounding supply chain sustainability is intricate and ever-evolving, demanding careful attention from businesses worldwide. Compliance with these regulations is not just about avoiding penalties; it’s about building a resilient and responsible supply chain that meets the expectations of various stakeholders.

Different regulations in the EU require companies, directly or indirectly, to engage their suppliers. These include, but are not limited to:

CSRD (Corporate Sustainability Reporting Directive): Mandates comprehensive sustainability reporting.

EUDR (European Union Deforestation Regulation): Focuses on preventing deforestation caused by specific products entering the EU market.

REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals): Regulates chemicals and their safe use.

CSDDD (Corporate Sustainability Due Diligence Directive): Requires companies to identify, prevent, and mitigate adverse human rights and environmental impacts in their operations and supply chains.

CBAM (Carbon Border Adjustment Mechanism): Imposes carbon tariffs on imports to prevent carbon leakage and promote cleaner production practices.

At the heart of this regulatory framework are the Corporate Sustainability Reporting Directive (CSRD) and the European Sustainability Reporting Standards (ESRS). These standards set the specific disclosure requirements that companies must follow to comply with the CSRD, ensuring consistency and comparability across different sectors and countries.

Corporate Sustainability Reporting Directive (CSRD)

The CSRD is a critical piece of legislation introduced by the European Union to enhance and standardize corporate sustainability reporting across member states. This directive replaces the Non-Financial Reporting Directive (NFRD) and significantly expands the scope of reporting requirements. The CSRD aims to ensure that companies provide comprehensive and comparable information on their sustainability practices, thereby increasing transparency for investors, consumers, and other stakeholders. Reporting under the CSRD is expected to begin by 2025, covering the reporting year 2024, and will be conducted using the ESRS.

If you're interested in reading more, check out the article below:

European Sustainability Reporting Standards (ESRS)

To operationalize the CSRD, the European Sustainability Reporting Standards (ESRS) were developed. These standards set the specific disclosure requirements that companies must follow to comply with the CSRD. The ESRS provides detailed guidelines on how companies should report on various sustainability metrics, ensuring consistency and comparability across different sectors and countries.

Tropical Standards Requiring Supply Chain Action

Within the ESRS framework, there are six key tropical standards where supply chain action is essential:

Climate Change Mitigation and Adaptation: Reporting on efforts to reduce greenhouse gas emissions and adapt to the impacts of climate change.

Pollution: Addressing actions taken to prevent, mitigate, and remediate environmental pollution.

Water and Marine Resources: Ensuring sustainable management and conservation of water and marine resources.

Biodiversity and Ecosystems: Protecting and restoring biodiversity and ecosystems affected by business operations.

Circular Economy and Resource Use: Promoting sustainable resource use and circular economy practices.

Social and Human Rights: Upholding human rights and social standards within the supply chain, including labor practices and community impacts.

Understanding and fulfilling these expectations not only helps businesses avoid future legal pitfalls but also positions them as leaders in sustainability. This comprehensive approach is crucial for building a resilient and sustainable supply chain that can withstand the challenges of the modern world.

Understanding the "why?" behind any requirement is crucial. In the case of various disclosure requirements under the ESRS, they all originate from the EU Green Deal. The EU has set very ambitious targets, requiring companies to actively participate in achieving them.

Each of these standards directly connects to one of the EU Green Deal strategies, goals, targets, or initiatives. Moreover, there are numerous interconnected aspects between these reporting standards and other EU regulations mentioned earlier in this article. We will now explain the interconnection between the Green Deal and the ESRS.

The ESRS is a disclosure standard designed to meet the requirements of the CSRD, which in turn aims to support the objectives of the EU Green Deal. But how are these connected?

Climate Change Mitigation and Adaptation: Reporting on efforts to reduce greenhouse gas emissions and adapt to the impacts of climate change.

Pollution: Addressing actions taken to prevent, mitigate, and remediate environmental pollution.

Biodiversity and Ecosystems: Protecting and restoring biodiversity and ecosystems affected by business operations.

Circular Economy and Resource Use: Promoting sustainable resource use and circular economy practices.

Social and Human Rights: Upholding human rights and social standards within the supply chain, including labor practices and community impacts.

If you're interested in reading more, check out the article below:

Competitiveness: Leveraging Sustainability in Supply Chain

In the evolving business landscape, competitiveness increasingly hinges on sustainability. As companies navigate regulatory requirements and stakeholder expectations, the ability to demonstrate a sustainable supply chain has become a critical differentiator. One significant driver of this trend is the rising emphasis on sustainability in public tenders.

Sustainability in Public Tenders

Public procurement policies are undergoing a transformation, with a marked increase in the inclusion of sustainability criteria. Governments and public sector entities are using their purchasing power to drive sustainable practices across industries. This shift is not limited to a company’s own operations but extends deep into their supply chains. The implications are profound: to win contracts, businesses must not only showcase their sustainability credentials but also ensure that their suppliers adhere to similar standards.

This trend is particularly pronounced in certain industries, such as construction, healthcare, and transportation, where the environmental and social impacts of supply chains are significant. However, the overarching trend is clear across sectors: sustainability is becoming a non-negotiable component of competitive tendering.

Industry Dependence and Supply Chain Implications

While the degree of emphasis on supply chain sustainability may vary by industry, the overall direction is unmistakable. Companies in sectors with high environmental and social footprints are under more pressure to demonstrate comprehensive sustainability measures. For instance, in the construction industry, tenders increasingly require detailed disclosures on the sourcing of raw materials and energy use throughout the supply chain.

This focus on sustainability in tenders has cascading effects. Businesses are now compelled to scrutinize their supply chains more closely, ensuring that their suppliers comply with sustainability standards. This not only helps in meeting tender requirements but also positions companies favorably in the eyes of customers and investors who are increasingly concerned about environmental and social governance (ESG) factors.

Customer Expectations and Supply Chain Actions

The emphasis on sustainability in public tenders is mirrored by rising customer expectations. Customers, both individual and corporate, are becoming more aware of the environmental and social impacts of the products they purchase. As a result, they are increasingly questioning companies about their supply chain practices.

Businesses that proactively engage with their suppliers to ensure sustainability can better address these customer inquiries. By fostering transparency and accountability throughout their supply chains, companies can build trust and enhance their brand reputation. Moreover, this proactive approach can uncover inefficiencies and risks, leading to more resilient and agile supply chains.

Competitive Advantage through Sustainability

When applied properly and not just for the sake of reporting data. sustainable practices along the supply chain can help companies differentiate themselves in the marketplace:

Market Differentiation:

Companies that excel in sustainability can stand out in the marketplace.

Attract ethically-minded customers who prioritize responsible practices.

Contract Opportunities:

Secure lucrative contracts, particularly those with stringent sustainability requirements.

Enhance appeal in public tenders focusing on sustainable practices.

Cost Savings:

Achieve improved efficiency through sustainable practices.

Reduce waste, leading to significant cost savings.

Enhanced Reputation:

Build a positive brand image by committing to sustainability.

Foster trust and loyalty among stakeholders and consumers.

In summary, the growing focus on sustainability in public tenders and customer expectations underscores the importance of integrating sustainability into supply chain management. By doing so, companies can enhance their competitiveness, secure more contracts, and meet the rising demand for responsible business practices. Embracing this trend not only fulfills regulatory and tender requirements but also positions businesses for long-term success in an increasingly sustainability-conscious market.

Investment Attraction: The Role of Sustainable Supply Chains

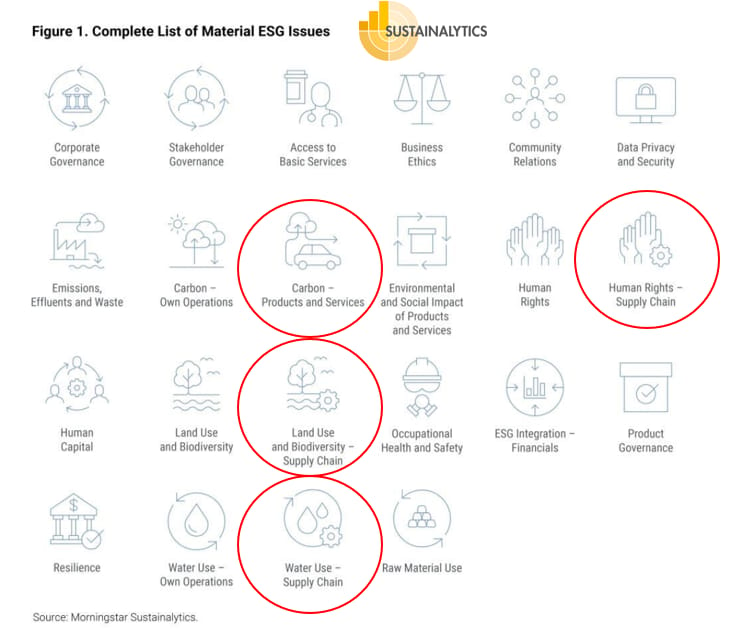

The growing emphasis on sustainability in investment decisions is reshaping how companies approach their supply chains. Investors are increasingly looking for businesses that demonstrate strong environmental, social, and governance (ESG) practices, and a sustainable supply chain is a critical component of this evaluation. This shift is driven by rating agencies and frameworks that prioritize sustainability, such as Sustainalytics.

ESG Ratings: A Crucial Tool for Investors

As discussed in my Sustainable Finance article series, ESG ratings have become a crucial tool for market participants, offering valuable information that supports investment decisions and directs funds towards more sustainable businesses. Investors increasingly rely on these ratings, often valuing them above a company’s own disclosures, to gain a comprehensive understanding of corporate ESG performance. This reliance underscores the importance of ESG ratings in identifying and investing in companies that address sustainability risks and are committed to responsible and ethical practices.

Investment Attraction and Supply Chain Sustainability

Below is a graph illustrating the various aspects of the supply chain covered by Sustainalytics, a leading ESG rating provider.

I don’t want to delve further into the topic here as I covered sustainable finance extensively in three articles. I encourage you to check out these articles for a deeper understanding of how sustainable practices influence investment decisions and the methodologies used by rating agencies.

Risk Management: The Crosslinkage Between All Pillars

Risk management serves as the crucial crosslinkage between regulatory compliance, investment attraction, and competitiveness, making it a vital pillar for any organization aiming for sustainable supply chain management. Effective risk management encompasses a broad spectrum of potential challenges, from regulatory changes to competitive pressures and stakeholder requirements. It also involves seizing opportunities, ensuring that businesses are resilient and adaptable in a rapidly evolving landscape.

One of the primary risks businesses face is the continuous evolution of regulations. Regulatory landscapes, especially concerning environmental and social governance, are in a constant state of flux. Companies must stay ahead of these changes to avoid non-compliance, which can lead to legal penalties, financial loss, and reputational damage. Effective risk management requires ongoing monitoring of regulatory developments and proactive adaptation to new requirements. This ensures that the organization remains compliant and can anticipate and prepare for future changes.

Addressing Competitive Pressures

In the realm of competitiveness, companies must continuously innovate and adapt to maintain their market position. Competitors who swiftly integrate sustainable practices can gain a significant advantage, attracting more customers and securing better terms in public tenders. Risk management in this context involves identifying potential competitive threats and opportunities, enabling companies to respond effectively. By embedding sustainability into their core strategies, businesses can differentiate themselves and enhance their competitive edge.

Meeting Stakeholder Requirements

Stakeholder expectations are higher than ever, with consumers, investors, and partners demanding greater transparency and responsibility. Failure to meet these expectations can result in loss of trust and investment. Risk management involves understanding and addressing these diverse stakeholder requirements, ensuring that the company’s practices align with the values and expectations of its key stakeholders. This alignment not only mitigates risks but also builds stronger, more trusting relationships.

Securing and Attracting Investment

The link between sustainability and investment attraction is clear, as discussed earlier. Investors are increasingly prioritizing companies with robust ESG practices. Risk management here involves ensuring that the company meets the stringent criteria set by ESG rating agencies, thereby securing and attracting investment. This includes transparent reporting, compliance with standards like CSRD and ESRS, and proactive engagement with rating agencies.

Risk management is the backbone that supports the other three pillars of sustainable supply chain management. By proactively identifying and addressing risks related to regulatory changes, competitive pressures, and stakeholder requirements, businesses can not only mitigate potential downsides but also leverage opportunities for growth and innovation. Integrating double materiality into risk management processes ensures a holistic approach, considering every potential or actual impact on the business and the environment. This comprehensive strategy is essential for building a sustainable, resilient, and competitive supply chain in today’s complex global landscape.

Seizing Opportunities through Double Materiality

Double materiality is a concept that addresses both financial and non-financial aspects of business operations, considering how sustainability issues impact the company and how the company impacts the environment and society. This approach is crucial for comprehensive ESG intgration, as it ensures that all potential and actual impacts are considered. By adopting a double materiality perspective, businesses can identify new opportunities and mitigate risks effectively.

Conclusion

In conclusion, it is definitely a necessity to assess potential impacts, risks, and opportunities along the supply chain. As we know, and as COVID-19 has proven, our world is interconnected, and disruption in one part of the world affects everywhere else. Therefore, it is not a burden; rather, if tackled correctly and gradually, it will lead to various opportunities along the supply chain. This includes building a resilient supply chain and optimizing every aspect of it.

To answer the main question, "Can You Turn Compliance into Competitive Edge and Secure Investments?" the short answer is yes. The long answer is that by integrating robust supplier engagement and due diligence processes, aligning with regulatory standards, meeting investor expectations, enhancing competitiveness, and managing risks effectively, businesses can transform compliance into a strategic advantage. This approach not only ensures adherence to regulations but also opens doors to investment opportunities, strengthens market positioning, and builds a resilient and efficient supply chain. Embracing sustainable practices is not just about compliance or meeting stakeholder demands—it's about strategically positioning your business for long-term success and competitive advantage.

1 Must-See Post: Leading the LinkedIn Feed

This post describes the importance of corporate responsibility across the entire value chain, driven by EU regulations. Key focus areas include skills development, teamwork, and adopting new mindsets for effective sustainability transition. Embrace evolving roles and responsibilities to meet disclosure requirements. Link

2 Great Insights - A Book I am Reading

Title: Building a Second Brain

Author: Tiago Forte

As the title suggest this book provides a framework for managing information and boosting productivity. The book introduces practical methods for capturing, organizing, and utilizing knowledge effectively, helping individuals enhance their creativity and efficiency. By leveraging digital tools and structured techniques, Forte empowers readers to build a personal knowledge management system that supports continuous learning and improved performance.

Capture and Organize Information Effectively: Forte outlines the PARA method (Projects, Areas, Resources, Archives) for organizing digital information. By categorizing data into these four categories, you can easily retrieve and use information when needed, ensuring nothing valuable is lost or forgotten.

Progressive Summarization: This technique involves summarizing notes progressively over time, distilling them to their essence. Always consider that you are leaving notes for your future self; this habit will change how you take notes. It helps in retaining the most critical insights and making information more accessible for future use. This approach not only boosts creativity but also enhances productivity by allowing you to focus on the most important elements of your notes.

3 Key Takeaway - Podcasts on the Move

Title: Josh Kaufman @ The Diary of a CEO

Host: Steven Bartlett

In this podcast episode, business expert and author Josh Kaufman discusses the fundamental aspects of business and how understanding these can empower individuals in their careers. He emphasizes the importance of value creation, marketing, and practical steps to grasp business essentials. Kaufman also shares insights from his book, "The Personal MBA," highlighting the value of self-education and practical skill acquisition over traditional business education.

Three Key Takeaways:

Value Creation: Identifying unmet needs and creating solutions that people are willing to pay for is the cornerstone of any successful business. This involves deeply understanding customer desires and pain points.

Skill Acquisition: Josh Kaufman challenges the notion that one needs formal business education to succeed. Instead, he advocates for practical, self-directed learning, emphasizing that significant skills can be acquired through dedicated effort and focused practice, often requiring much less time than traditionally believed.

Market Research: Kaufman underscores the importance of observing real-world behaviors and frustrations to identify business opportunities. Entrepreneurs should look for everyday problems and find innovative solutions, often through simple yet effective market research techniques like early pre-orders or customer interviews.

Articles that might interest you: